NexGen Learning Systems T-Grid 2019-20

Author: Craig Weiss

Go to Source

Nowadays every learning system vendor out there will tell you their system is Next Generation or some nuanced spin that goes towards NexGen. The problem is that for most of the systems, it just isn’t the case. This is due to a couple of key factors:

- They do not know what constitutes a system to be NexGen

- They think the features they have, because they haven’t seen anything like it anywhere else (mainly because they only look at a few systems), is NexGen

- They are brand new to the market, so they must be NexGen

While that all sounds good and likely works for marketing purposes, for me, it just doesn’t fly, because there has to be a set of functionality, etc. to be listed as NexGen, and then various tiers too. I mean NexGen of 2017 is not the same as a system that is NexGen 2019, or at least you hope it is not the same.

In the past, I went with a single grid with four quadrants – see the 2018 listing here.

For 2019, I decided to go a different route by creating what I called a T-Quad, but its better name is a T-Grid. T representing three.

This post will break down as follows (for fans of Work Instructions, enjoy!)

a. The T-Grid entire view – With all the details tied to it, including what you are looking at, how it was calculated, etc.

b. Breakdown of each Grid – Leaders, Risers, Steady – and each vendor that is in that grid.

c. What I consider Tier 3 NexGen which uh, played the key role here. A system should ideally have all these features, albeit some were missing a piece here and there, hence you will see shortly what that means.

d. Download the PDF version of the T-Grid.

e. An FYI that every system in this year’s grid can be found in FindAnLMS, so I strongly recommend you checking them out for further details on each of them, pricing, etc.

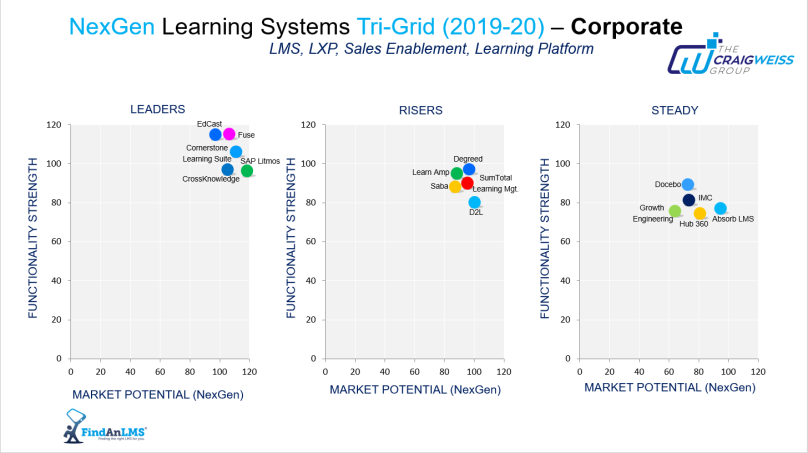

The 2019-2020 NexGen T-Grid

How to Read The Grid

Very carefully. Zam! Okay, in all seriousness, there are three grids in the T-Grid (remember T stands for three).

Leaders – The Systems that are NexGen to the max (Tier 3 at least 95% – now). They are 100% Tier 2, and 100% Tier 1, NexGen.

Risers – Systems that are Tier 3 NexGen at least 92% Tier 3. These are systems to watch, up and coming or potential leaders in 2020-21, depending on where they go from here.

Steady – Steady as it goes for NexGen. At least 85% Tier 3. So, they could be 100% Tier 2, but only 88% Tier 3. Some could be ones to watch, not yet at Risers, but with a few of this or that, could be, or ones that have hit a wall in terms of NexGen. Just enough to score well, but trend lines pointing that this may be the best they get, even if they continue to add NexGen, they are still behind the curve to rise.

Grid Specifics

Functionality Strength

Based on what I defined as Tier 3 NexGen functionality (see down the page, under “Criteria Functionality”), the higher the score rating, the higher the level of well, strength. If you want say, the ultimate NexGen system with Tier 3 functionality, then, a system whose functionality rating is 120 or close to it, will fit the build.

120 is a perfect system. Since, I do not believe that any system is 100% perfect, hitting 120 is not really doable, but the rating scale does go that high, just as it goes as low as 0. If you are 0, then you are not a learning system. Rather, you are an imaginary friend who thinks he is a server.

Each section of Tier 3 functionality was weighted. Some higher than others, which when you added up the total point scale, you ended up where they were on the grid.

Market Potential Growth (NexGen)

What is the potential that this system will continue on the path of NexGen for 2020, and then 2021? This includes Tier-4 NexGen functionality (to be published in Feb). A trend line was defined based on previous years of NexGen, i.e. Tier 1, Tier 2. Track record of success played a role here. Everything was weighted with points assigned to each Tier, and year of achieving at least 90% of each previous Tier, i.e. Tier 1 and Tier 2, in their respective years.

If the system is brand new but has Tier 1, and Tier 2 when they launched in 2019, then one could extrapolate the likelihood of them continuing to evolve in 2020, since they have a set percentile to slide into “Steady” for Tier-3. The only vendor that fits this bill is Hub360, which is in Steady. And a system that is one to watch for 2020, from a NexGen standpoint, especially as a Sales Enablement Platform.

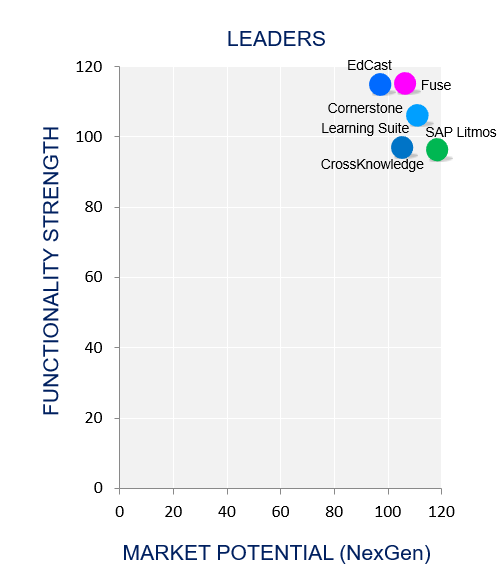

The Leaders Grid

Any of these systems from a NexGen standpoint, would fit the bill. They are the best of the best in terms of Next Generation functionality, with the minimum scoring 98.5 on the Functionality Strength Scale. Their market potential to continue to hit NexGen in 2020-21, is at least 99, with the majority going over 100.

On the Functionality Strength Scale in order of Tier-3 functionality (for those who are fans of rankings)

Tied for 1 – EdCast (LXP) and Fuse (who pitches themselves as an LXP, but I would argue they are more a learning ecosystem and/or an LMS. The points total was less than a point separate, hence to me a tie. If you want to be one of those folks that says, that small minimal less than a point matters, then Fuse tops in at #1.

Fuse has the best and most robust analytical data capture and visualization I have seen in the industry. The key reason is that they have Good data, a BI tool built-in to the system (at no additional charge). Good Data can capture over 300 metrics of data, although that is not available or presented in the system itself. Still what is available is extensive.

3. Cornerstone Learning Suite – This is the learning suite here, not the entire Cornerstone system.

4. CrossKnowledge – The LMS, and not their brand new system, CK Connect (review coming in Jan.), CrossKnowledge has the second best data visualization I have seen so far.

5. SAP Litmos – Last year’s top system for NexGen, still a very strong player, a leader in the space, but the others – those listed above, have more Tier-3 then Litmos. But still, they have at least 95% Tier-3.

Market Potential

SAP Litmos is close to the 120 as you can get.

But, any of the leaders are likely to as well, just the fast track record of previous NexGen indicates that SAP Litmos has a high probability of achieving those results.

Cornerstone Learning Suite is next in line, they were a little slow with Tier 1, but upped their game in Tier 2 and definitely Tier-3. The system needs some tweaks, but from a NexGen standpoint, which is what this grid only focuses on, they show a high trend line to achieve going forward.

Fuse slides into three if you will, for those focusing on ranking of scale ratings for market potential. CrossKnowledge is slightly behind them, but just barely.

EdCast, while truly deserving in the leader grid, will definitely have some Tier-4 features, based on previous track record of other tiers, but being an LXP opens them up to whether they continue down the LXP path, or try to be more of a learning ecosystem or an LMS or hodgepodge of something yet to be known. Since Tier-4 will have certain functionality only for LXPs, versus the rest of the learning system space, a big unknown is based on the route they go, will they hit all of Tier-4 for that area? Indications say yes, regardless, and they are a NexGen system on the market potential for 2020, but say, 2021? Will they continue to be a leader or will they drop into steady? Right now, I see them clearly as a yes in the leader grid.

At the end of the day, if you want a robust NexGen system any of the leaders will deliver, regardless if they are an LXP, LMS or Learning ecosystem.

Risers

These are up and coming, on the rise from the standpoint of Tier-3 NexGen. They all could say they are NexGen and they would be making an accurate statement. Two are LXPs for now, the other three are LMSs.

Functionality Strength

For folks who want systems on the rise from a next generation standpoint, this is the grid for you. The biggest surprise to me is Saba. I was actually stunned to be quite honest, because their track record for Tier-1 was slug level, and Tier-2 was better but by no means elite, so what they were able to do in terms of Tier-3 is quite impressive. Again, this is in reference to the learning portion of Saba and not the entire platform of talent, etc.

Degreed is the closest at this point to jump to the Leaders Grid, but to achieve that they need to improve on their analytical data metrics and two capabilities within the video management Tier-3 features.

Learn Amp is an outstanding LXP (Top 10) and a top ten learning system for 2019-20. They continue to push on the NexGen.

SumTotal. I have seen the new UI on the admin side that is coming out in Q1 2020, and it is a major upgrade from what they have now. Strength of NexGen is again on the rise.

D2L is relatively new to the corporate market, and for NexGen that is the market I looked at for them, and not from an HE or education standpoint (for those wondering). I like where this system is heading, and the levels of achievement for Tier-3 tells me they understand what they need to do in this market, to continue growth.

Market Potential for NexGen

Saba is the unknown here, because of their previous track record. I definitely see them hitting quite a bit of Tier-4, but as a system who is more of an HCM, there is always a concern on where the R&D will be heavily pushed to. I hope it is Learning, but my sense will be the performance more so (as it has in the past). When that roles into play, the NexGen market potential for 2020 will exist, so you can’t go wrong here, but for 2021- I have to wonder, as they could easily slide into Steady or drop completely. Still, for the next year at least, I see them as NexGen.

Degreed is clearly going on the NexGen bent, but I still have doubts on where they see themselves by the end of 2020. If they align more towards a performance or talent mangement platform with learning experiences (yes, a term I despise), then how much of the R&D will be focused on learning, versus the other areas? And I do see them as different, i.e. talent development/mgt versus learning. So, yes, NexGen potential for 2020 is definitely there, and strong at that, but 2021, specifically for learning?

Overall in the Risers Grid, each of these systems are not only NexGen for 2019, but will be in 2020 too. I’d place good high marks on 2021, sans the two exceptions above, which will be dependent on some variables that have yet to be clearly ascertained to a degree (no pun intended) of 100% certainty.

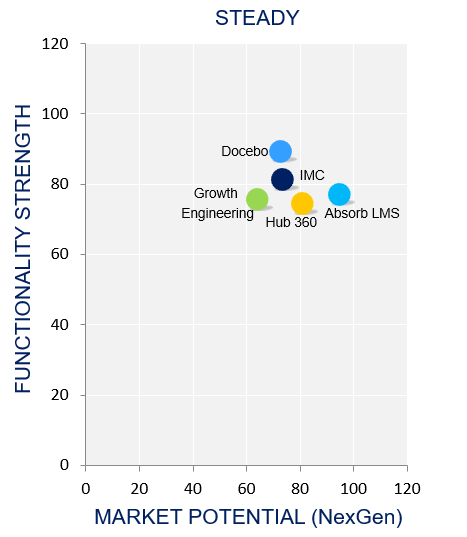

Steady

In the Steady group, IMC has the best chance I see as of right now, to move into the “Risers” or even “Leaders” Grid depending on what they do in 2020, from a Tier-4 standpoint. There is a lot of love in NexGen for their system, but they are missing just enough to keep them from going into Risers.

Absorb LMS is another vendor that with a few of this and that, could jump into Risers, but for now, they are in the Steady category. Again, this is relating to NexGen only.

Docebo is a wild card here. Some of their NexGen Tier-3 is very good, other is just barely above average, and of course, they are missing a few Tier-3 features. Analytical data is a weakness in terms of metrics capture, and at one time say in 2017, they were truly a great NexGen system. In 2018, they slipped a bit, and in 2019, they are in the speed bump area, not hitting a wall, but coming close enough, to make you wonder, where they plan to go from a Next Generation standpoint.

I’ve already talked about Hub360, which includes the NexGen system of Spoke (Tier 1 and Tier 2 with a few Tier 3) as a component of the platform. Make no mistake, this is a very good sales enablement platform, new to the market, with Tier-3 existing within.

Growth Engineering. If someone would have told me they would be in the Steady category in 2019, I’d be like, “no way”, but here we are in 2019-20, and there they are – in the steady grid. Growth was slow to Tier-3 functionality, then moved forward to add as much as they could for 2019, but frankly should be higher at this point then where they are, currently. They have enough to slide them into this grid, but from a market potential for 2020, well if you look at their scale rating for market growth, I think you can ascertain my concern.

Market Potential for NexGen

Each of the vendors in the Steady Grid, I see as more than likely to achieve NexGen Tier-4 at some level (higher for some than others) in 2020 and then into 2021. As with anything, there is always a wild card, and the one vendor that screams that is Growth Engineering.

They were late to the game with a content marketplace, and although many vendors do not even have one, none of those vendors were in the NexGen Leaders Quadrant in 2018.

Knowledge Arcade which is a very cool mobile app from Growth Engineering is part of this wild card. I can easily see Knowledge Arcade, which is a standalone app, but you need the Genie authoring tool from Growth Engineering to use it, turning into the higher percentage of business from them by the end of 2020, and definitely in 2021. As such, it gets back to R&D, and can a system like Growth who has a new admin side UI rolling out, continue to keep the NexGen Tier-4 functionality on track or will they put more into Knowledge Arcade than the system itself? Thus, the reason behind them scoring slightly above 60 in the market potential scale rating.

The other four vendors are very likely to achieve NexGen status in 2021, and definitely are NexGen for 2020.

Criteria for Functionality

There is a lot here, so the way it will be presented is by a header followed by bullet points of the features. For example, Playlists is the header then there will be certain features that qualify as Tier-3. A vendor may refer to a playlist as a channel or some other term, but when I look at it, I see “Playlist”. The same with skills management. Some vendors may call it competencies or competency and skills or whatever. I look at it from skills management perspective.

Functionality areas that were weighted the highest

As with anything, there are certain functionality areas that are more geared towards NexGen than others. I mean ad-hoc reporting is not NexGen it is a standard nowadays in a system. Nor are course standards, NexGen.

The areas listed below were weighted the highest (and what Tier-3 features that are contained within them)

- Machine Learning

- Playlists

- Curation

- Mentoring (some vendors refer to this as Coaching)

- Video Management

- Skills Management

- Metrics – Analytical Data tied to data visualization outputs

- Connectors

- Content Marketplace

Connectors refers to the number of systems or platforms, the learning system can connect to, beyond the usual fare of Workday, ADP, Oracle, SAP, Lawson, Salesforce, SharePoint, and any other HRIS or HCM system or SIS for that matter.

Some examples of the connectors that would slide under “Connectors” category would be

- Slack, Microsoft Teams

- Dropbox, Google Drive, OneDrive (Microsoft), iCloud, Box.com

- Zapier (if offered)

- Office 365 (cloud), Survey Monkey, Constant Contact

- Github and so forth

Content marketplace are the number of content providers that a client can buy content from that goes into your system.

Under the Key Areas (Weighted higher) Tier-3 NexGen Features

Machine Learning

- AI in system can scan documents, courses, content, audio and video files and produce text results in a transcript or similar items

- Recommends courses/content based on job role, skill and/or additional variables

- Can create a learning path based upon recommendations using algorithm over a period of time

- Ability to include other items to enhance recommendation of courses/content

- Recommends content/documents/videos/etc. based on in progress/completed courses or content

Playlists

- Learner interests/topics playlist

- Learner currently taking playlist

- Assigned learning playlist (for the record, I am not a fan of “assigned learning” in an LXP)

- Learners can add Podcasts to their playlist

- Learning System Vendor creates curation content playlists

- Learner can create their own content playlist and share it with others (who may subscribe depending on system)

- Learner can create multiple playlists

- Manager can create playlists for their direct reports

Curation

- System offers contextual actions

- System can generate recommended content via the machine learning algorithm

- Client can create their own courses (via system or 3rd party) and sell them on vendor’s course marketplace – to other clients in the vendor’s system

- Content excluding courses can be listed in the trending/Most Popular and/or Recommended

- Learner can add video (regardless if it is uploaded or already on their computer/device), images, content (via the web, including links), content via file (uploaded) to a playlist

Mentoring

- Learners can add media, content or other deliverables to their responses

- Learner can share responses to question or questions with other learner or learners or groups, etc.

- If one person is designated or selected by learner, the learner contacts the “mentor” via some mechanism (to be defined) within the LMS; all information and data is captured on the back end of the LMS (viewable by administrator)

- Coach/mentor can communicate with the learner via web cam or other solution within the Learning System

Video Management

- Video content can be extracted as a text transcript seen on the same screen (either below or next to the video)

- Video text transcript – learner can click on different words or sentences and the video will go to that exact point, enabling the viewer to watch that specific segment

- Ability to bounce/move to different video points in video without having to go in a linear (straight) approach. Appears as pointers. End user can leave and go back at any time to that exact point in the video

Skills Management

- Create your own library of skills, including definitions

- Match a skill or a series of skills to a piece of content/a playlist

- Track skills by content

- Skills rating(s) – rated by the learner for each skill they identify as having

- Administrator can create, edit, delete skill rating(s)

- Manager can create, edit or delete skill ratings for their own team

- Skills tied to job roles/job profiles, which can be used to submit to jobs within the company (if applicable/available as part of the system)

- System can generate a playlist based on skill rating, skill level or any other skill related variable (achieved via machine learning)

- Allow managers to assess an employee’s existing skills

Metrics

- Analytics include tracking to web sites (this is for LXPs, not an LMS)

- Learner tracking data (by content, learning path, etc.)

- Built-in business intelligence component or connection to a 3rd party business intelligence tool (included at no additional charge to the client)

- Create KPIs and report on them

- Heat maps with correlating data

- Data Visualization

Other Items

- Profile can list their skills and/or skill-sets, interests

- Playlists or channels can be shared via social media

- Ability to assign multiple certificates to a single course/content

- Administrator feature – Ability to drill-down on analytics for more information (Example: system shows total number of courses completed, administrator clicks on the graph and can drill down for addl info/data)

- Administrator feature – Ability to assign courses based upon skills needed/required for job role

Bottom Line

Congratulations to the Systems that have achieved NexGen Status as Leaders, Risers and Steady.

All of these vendors have the right to say they are NexGen, because

they

are.

E-Learning 24/7